Outstanding Info About How To Choose A Beneficiary

While applying for life insurance, you can name a beneficiary within the life insurance application form.

How to choose a beneficiary. However, with the help of your trust attorney in orange county, ca, you may fill out a beneficiary designation form and make a bank account, social security benefits, or pension. A will beneficiary is someone who’ll inherit from your estate when you die. The primary beneficiary or beneficiaries are the entity or people that your life insurance policy pays out to in the event of your death.

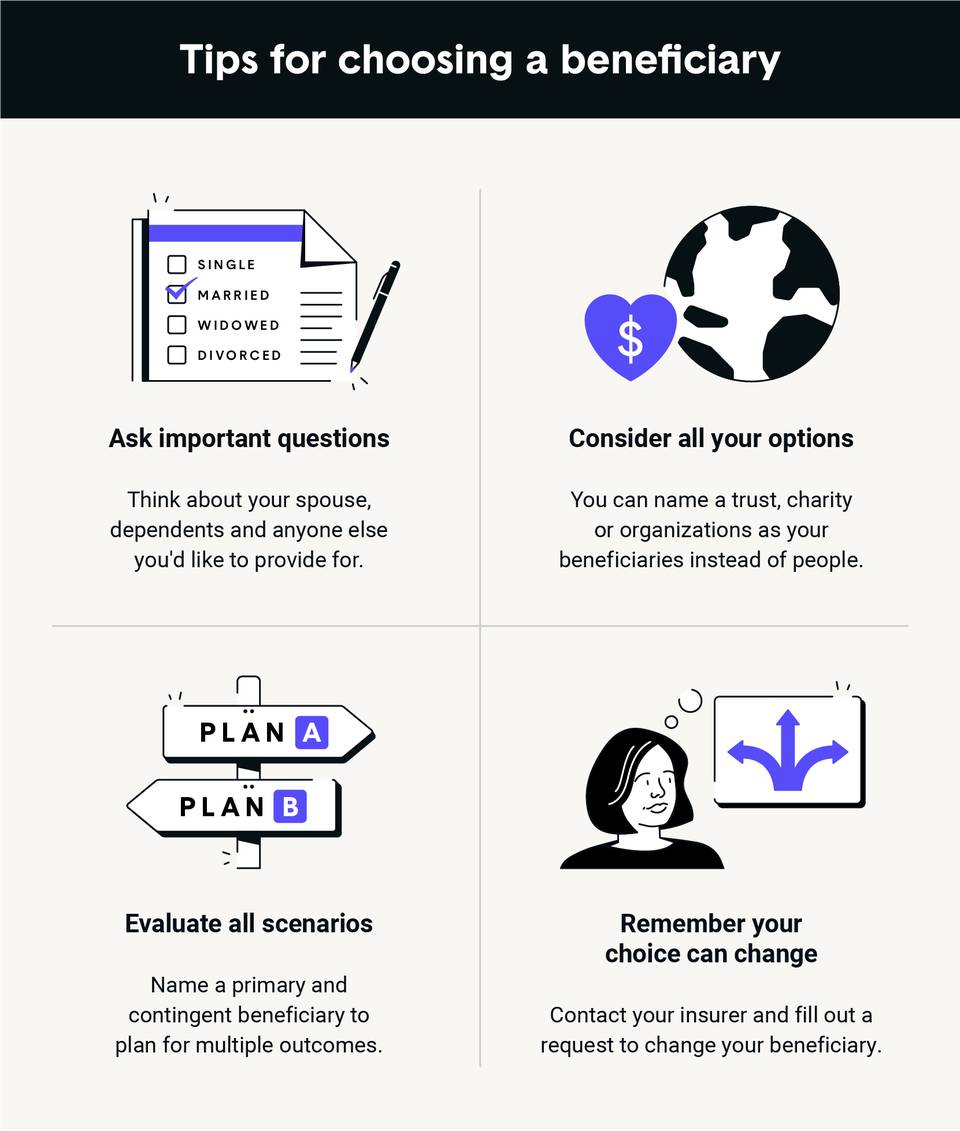

When choosing a beneficiary, you need to think about the people who depend on you financially. Since accounts and property have different tax treatment, choosing your beneficiaries based on their tax rates and how they may need to take distributions can help. For many, naming a life.

You may have many primary beneficiaries and split the payout. Your choice in beneficiary is unique to you and should align with the unique needs of your family. If you’re married, you’ll likely choose your spouse as the.

How to choose your beneficiary. Who needs your financial assistance? When choosing a beneficiary, consider the following:

Your beneficiary designations can change. When you choose multiple beneficiaries, you will have to describe how the assets should be should be divided. Which assets would you like to keep in the family?

The reasons for picking a beneficiary may differ depending on the purpose of the life insurance policy or type of account. You can name (or exclude) whomever you want and divide your estate however works for you. In choosing your beneficiaries and deciding who should inherit your things, ask yourself these questions: