Out Of This World Info About How To Find Out When I Will Get My Tax Return

You will need to enter your ssn, your date of birth, your return type (income tax or property tax), the tax year and the refund amount shown on your return.

How to find out when i will get my tax return. Your tax return amount is, in general, based on line 24 and line 33. Check for the latest updates and resources throughout the tax season You may be able to get a tax refund (rebate) if you’ve paid too much tax.

Request a copy of a tax return from the irs, prior year tax returns are available from the irs for a fee. While using the official irs’ where is my refund tool, get my payment tool or child tax credit portal is the best way to get. A super simple example would go like this:

The taxpayer must sign the form, and once the request is completed, the tax returns can be sent to a third party. Pay from your current or previous job. Getting your refund status via your irs tax transcript.

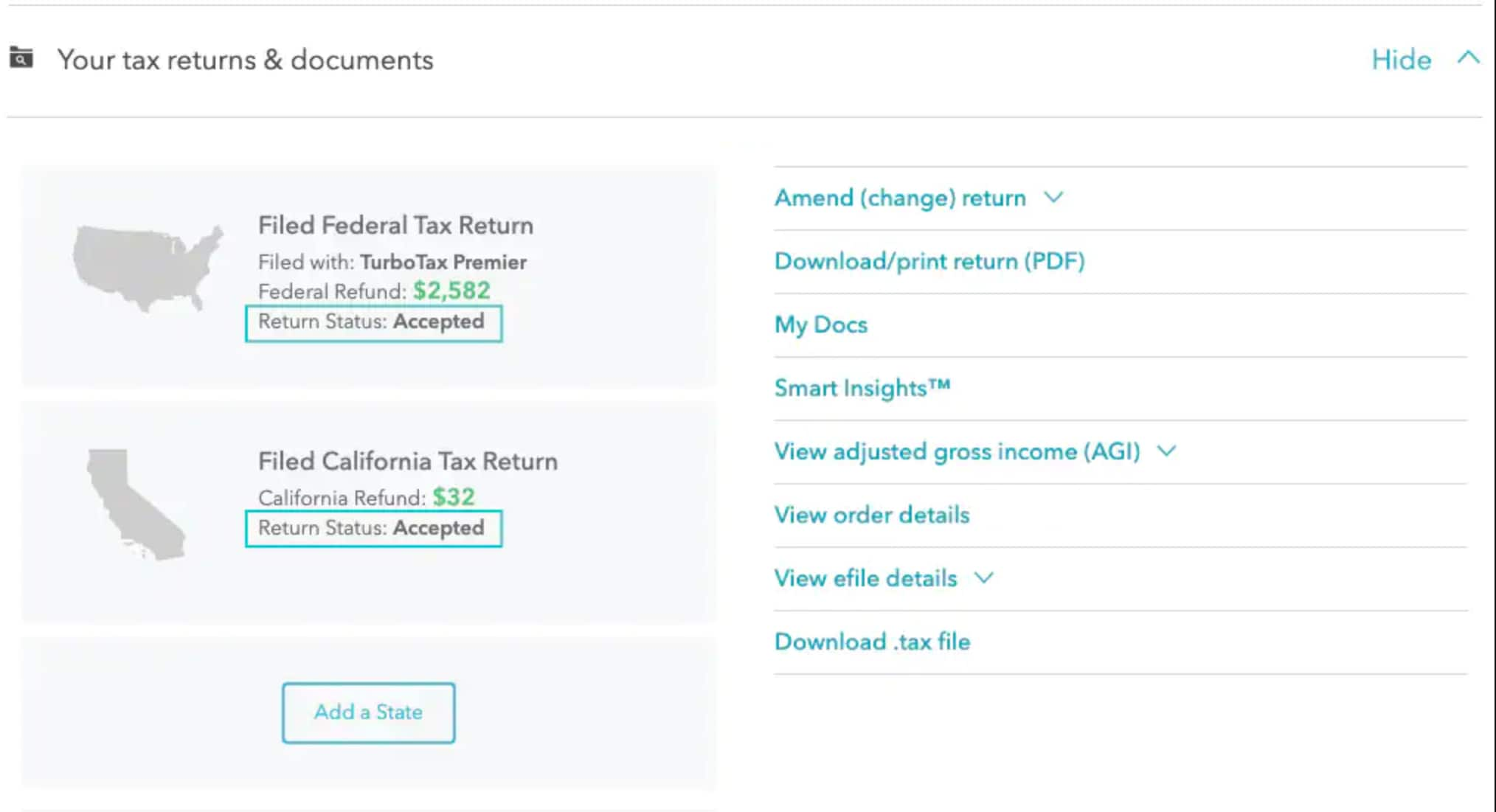

How do i calculate my tax return. Valid for 2017 personal income tax return only. Using the irs where’s my refund tool, viewing your irs account.

To verify your identify, you'll need. Taxpayers can request a copy of a tax return by completing and mailing. Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by:

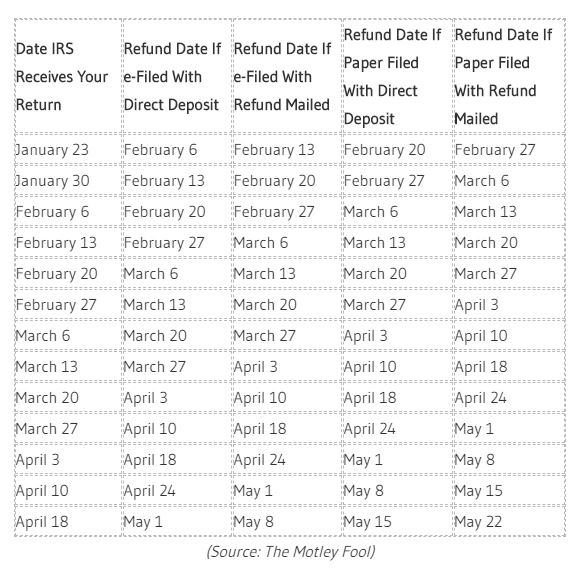

Please allow five to 10 calendar days for delivery. The most convenient way to check on a tax refund is by using the where's my refund? Type of federal return filed is based on your personal tax.