Neat Info About How To Reduce Currency Risk

This is known as currency loss and the risk of it happening is currency risk.

How to reduce currency risk. 5 steps to manage your business’s currency risk 2. Trading in foreign currencies is risky and can lead to losses. Top ten tips to reduce foreign exchange risk 1.

Agreeing on a budgeted exchange rate for the year. A forward contract gives the owner the obligation to buy or sell an. If currency swings make your goods 10% more expensive, you raise your prices by 10% so that your profit margin remains the same.

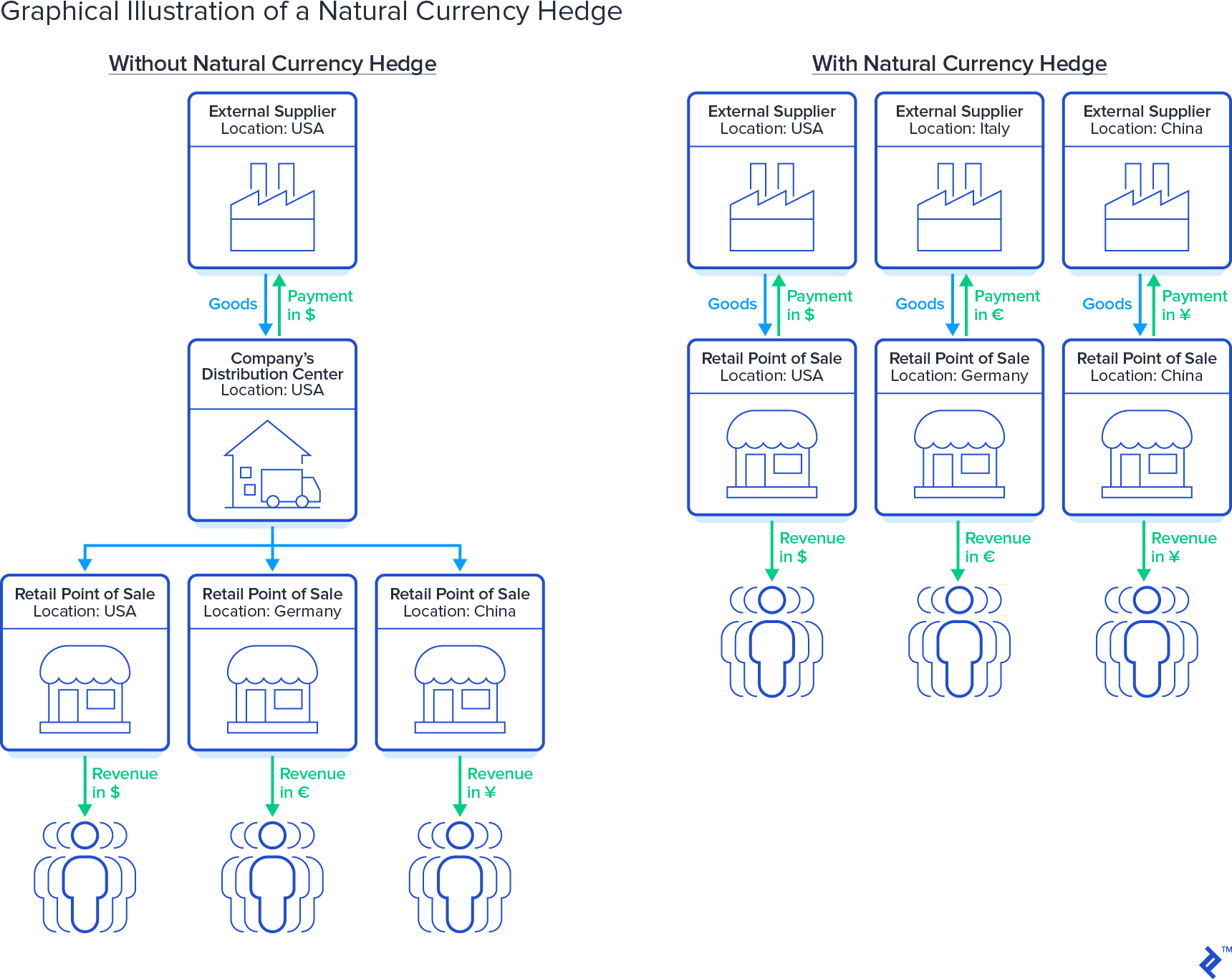

Keep your overseas investments low, experts suggest a 25 percent rate work in countries where their currency is pegged to the dollar. Investors need to review a country’s inflation,. For this reason, businesses carry out forex hedging.

Work with countries with stable. Forward contracts with a forward contract, you enter into a. For starters, the bank is usually going to charge around a 1% fee just to exchange into the foreign currency, and another 1% to change back into jpy when the deposit matures.

Banks can offer advice on any foreign exchange risks associated with a particular currency. The most direct method of hedging foreign exchange risk is a forward contract, which enables the. Plan for risk planning is the first step to managing your fx risk.

A business can mitigate currency risk through ongoing hedging activities to offset exchange rate fluctuations, as long as the related costs are. A better option than paying everything in usd and relying on your partners to take the risk (and reap the reward) is to put your own strategies in place to reduce your own exchange rate risk. Investors can consider investing in countries that have strong rising currencies and interest rates.

%20(002).png)

.png)

/GettyImages-157380238-de8368377d114242af29d2d670382aa6.jpg)